Simple ways to pay for Postal Life Insurance online Payment 2024 at PLI Online Payment portal https://pli.indiapost.gov.in/CustomerPortal/PSLogin.action

Postal Life Insurance

Dating back to 1884, Postal Life Insurance is among the oldest insurance service provider in India. The Company started as a welfare scheme for postal employees. However, PLI extended its limits accommodating the Telegraph department, female P & T department employees, and all public sector employees (central and state employees). PLI offers more than 50 lakh policies, thus availing comprehensive services to all.

Eligible Employees for PLI Policies

PLI is available to all central and state employees as follows:

- Defence services

- Para Military forces

- Local bodies

- Reserve Bank of India

- Public sector

- Nationalized bank

- Financial institutions

- All government-aided educational institutions

- Scheduled commercial banks

- Extra departments’ agents at the department of post.

- Workers at the Cooperative credit societies

- Autonomous bodies.

Pli.indiapost.gov.in

Features and Benefits of Postal Life Insurance (PLI)

- The policy provides a nomination facility/ beneficiary facility.

- It’s easy to borrow funds against your policy.

- Policyholders can revive a lapsed policy based on the Company’s directives.

- One can avail a duplicate policy document if they lost the original copy.

- Policy members can convert from one policy to another. For example, a whole life Assurance policy can change to an Endowment assurance policy.\

- Policyholders can request income tax exemption under the Income Tax Act section 88.

- The policy user can pay either monthly, quarterly, or yearly.

- A discount of 2% is available for users paying their amount in advance.

Requirement for Postal Life Insurance Online Payment

Every PLI policy user must have the following to complete online transactions.

- The registered mobile number at the PLI policy

- Email ID registered with the company.

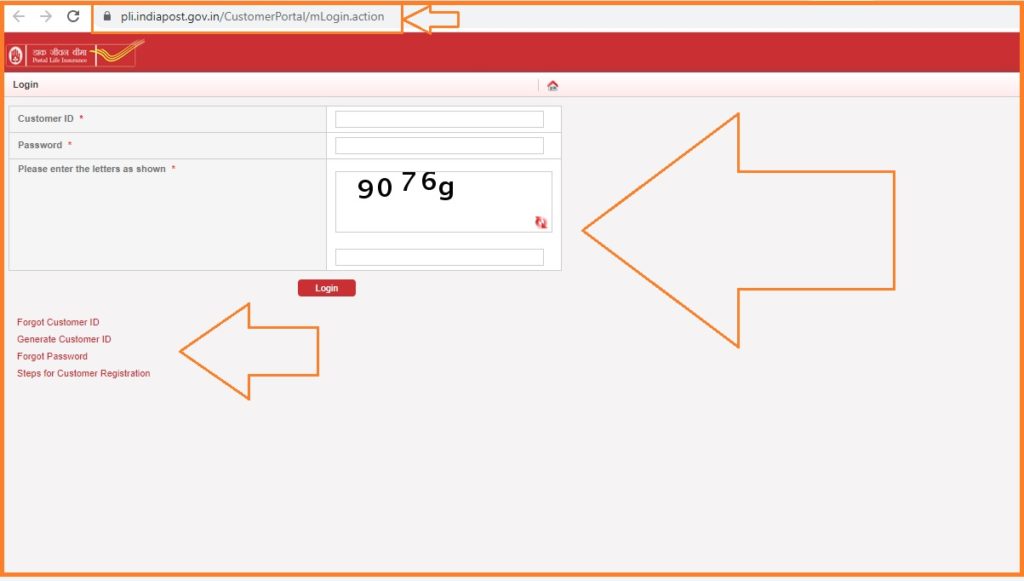

PLI Login

| Generate Customer ID | https://pli.indiapost.gov.in/CustomerPortal/mGenerateCustIDMain.action |

| Steps for Customer Registration | https://pli.indiapost.gov.in/CustomerPortal/mRegistrationSteps.action |

| Forgot Password | https://pli.indiapost.gov.in/CustomerPortal/mForgotPwdMain.action |

| Forgot Customer ID | https://pli.indiapost.gov.in/CustomerPortal/mForgotCustIDMain.action |

| PLI Customer Portal Login | https://pli.indiapost.gov.in/CustomerPortal/mLogin.action |

How to Register at PLI Customer Portal

Policyholders must register their details online and create login credentials to ease policy payment.

- Open the PLI customer website via the link

- https://pli.indiapost.gov.in/CustomerPortal/PSLogin.action.

- Next, select “generate customer ID” and enter the required details as indicated on your policy documents.

- Recheck the details and press submit button.

- A new message will show, and the customer ID and registration link will be sent to the email ID.

- The link is valid for 72 hours; open the link to proceed with the registration process.

- Once opened, the password reset page will show; create your preferred password to complete the process.

- The system will verify and update the registration details after 24 hours.

PLI Online Payment

Steps to pay for PLI premium policy online (using a credit card)

After acquiring login credentials, it’s easy to log in and complete the payment process.

- Go to the Postal Life Insurance website portal www.postallifeinsurance.gov.in/

- Proceed to the “login” tab and press the “policyholders” button to open a new page.

- Enter mandatory details like policy number, sum assured, insured, first name, date of birth, and contact details.

- Review the details and select the “submit” button.

- Next, enter your customer ID and password and proceed to the payment page.

- Select the premium payment tab and enter your credit card details.

- Enter the amount to pay to complete the process.

Other Postal Life Insurance (PLI) Premium Payment modes

- Mobile Banking Services

Mobile banking apps allow device users to pay for multiple services online. It’s easy to pay for PLI premium via mobile banking services in the comfort of your home.

- Fund transfer services

PLI premium policy users can utilize various fund transfer channels like:

- RTGS

- UPI

- IMPS

- NEFT

- QR Card

- Aadhaar Enabled Payment system.

Postal Life Insurance Login

| Postal Life Insurance (PLI) | https://www.indiapost.gov.in/Financial/Pages/Content/pli.aspx |

| Login | https://pli.indiapost.gov.in/CustomerPortal/mLogin.action |

| Customer Portal | https://pli.indiapost.gov.in/CustomerPortal/Home.action |

| Rural Postal life Insurance | https://www.indiapost.gov.in/Financial/Pages/Content/rpli.aspx |

| PLI agent login | https://pliagent.indiapost.gov.in/AgentPortal/Login.action#no-back-button |

FAQ’s

Can policy users pay premium policies direct from their salary?

Yes, it’s possible to auto-deduct your payment directly from the salary.

What is the fine for late payment?

If a PLI policyholder forgets to pay their premiums, a fine of 1% will apply per month.

PLI Full Form?

Postal Life Insurance (PLI)