The Bangalore BBMP property tax payment online 2020 – 2021 – 2022 – 2023 – 2024-2025 through online official website bbmptax.karnataka.gov.in

BBMP Property Tax Payment 2024-2025

Bangalore Property Tax Online Payment 2024-25: Bangalore popularly known Bengaluru is a well-established capital city of the known Karnataka state. The city has a large population and most the industries are built here. Most citizens and visitors familiarize themselves with city by the parks and nightlife. It is an enjoyable place to be in.

However with all this great stuff surrounding the city, it also depends and holds tax as it sole back bone. Bangalore government depends on the tax collected to pay majority or all its workers. They have different types of tax where some are in direct and direct.

Today let’s focus on the Bangalore property tax. What comes in the mind of many people when tax is mentioned? Most takes as the VAT charged on the items e buy or the fillings which happen before the financial year of the state government.

Bangalore Property Tax

Bangalore property tax is the finances collected by local municipal council/authority. They follow up the property owners who have to pay for the property owned. The money/tax goes to different tasks in the city. To repair damaged drainages, roads, parks, street light and even pay the works. All this service have to be provided to serve the citizens diligently.

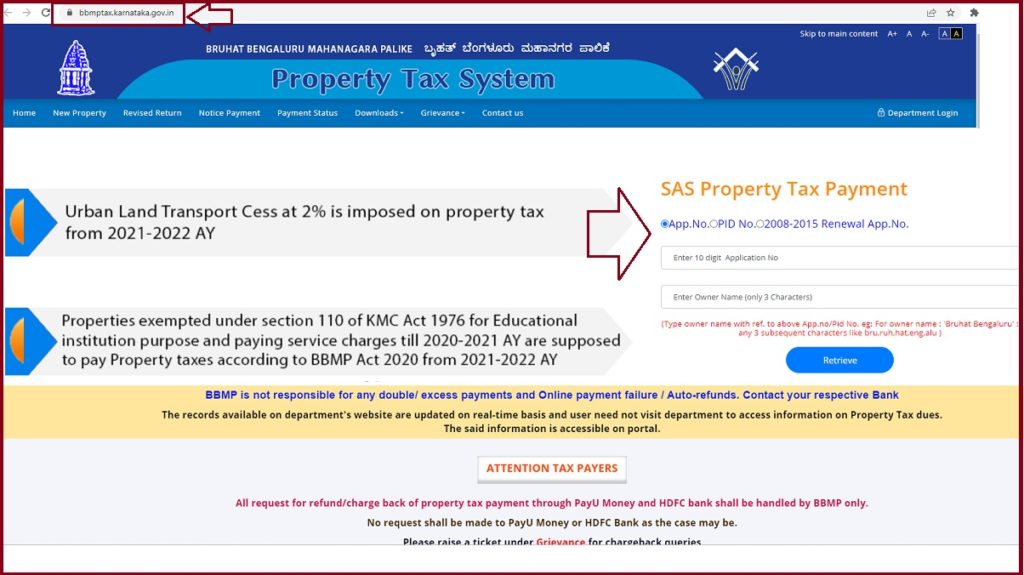

Bbmptax.karnataka.gov.in

Nevertheless the Bangalore government under the bigger Karnataka state have set a new way for individuals to check property tax. The online portal eases the burden of visiting property owners who are located all over the city. The new system is called Bruhat Bangalore Mahanagara Palike (BBMP).

This website has come in handy to both the government and property owners. One can check the value of their land before paying and see the changes given.

How to Pay Bangalore Property Tax (BBMP)?

There two different ways:

- Manual/offline process: here you have to fill the necessary forms and attach the payment demand draft. Drop the papers at the property tax offices for official fillings and also take a receipt of acknowledgement.

- Online method: considered as easiest way to pay tax in the city. You need to fill the fill online. The payments too are done online through the credit/debit card and net banking. Submit the form to the official website BBMP: http://bbmptax.karnataka.gov.in

BBMP Property Tax

How much Percentage Rebate on BBMP advance property tax payment 2024-2025?

- Yes, BBMP Offers 5% Rebate on advance bengaluru mahanagara palike property tax payment. So you can get 5% cash rebate by paying bbmp property tax before 31st July 2024.

Who pays the property tax and how one goes about it?

Matters of paying tax are very crucial and one needs a lot of knowledge about property tax. We can check the few details one need to learn:

- Know the yearly value of your property.

- All property have their class and category the government has divided them according to: residential, shops, godown, non-residential.

- Learn the zonal classification.

- Measurement of the property

- The whole area the property has covered.

- You have to know the floors the building has which also includes the basement.

- The area occupied by each floor/building on the same area of land.

Bruhat Bengaluru Mahanagara Palike Property Tax forms 2024-25

With this kind of information you will learn how to calculate your property tax. After this step one needs to learn the kind of form to pick. Don’t pay blindly check and read the following forms:

Form I

Property identification number (PID) is unique number issued to the property owner. The number has all the data about the property where it’s locate the area occupying and plot number. The form is issued to all the individuals with the PID.

Form II

Khata number is also a very unique number issued to the land and property owners. It has the details about the property. The form II is given to property owners who don’t have the PID but have the Khata number.

Form III

This form is filled by individuals who don’t have either the Khata number or the PID. They are not left out, with this form details about their property will be recorded.

Form IV

This form is issued when the owner has not made any changes on the property. Changes like increasing or decreasing of the land, it is white in color.

Form V

If there are any slit changes on the property like adding a floor, purchasing more property demolishing of a floor and even selling part of the property. This will be filled in the form V which is blue in color.

Form VI

This for the property which is not on the list of paying tax. They property owner only give a service fee which is paid using this form.

How to Calculate BBMP Property Tax?

One needs to learn how to calculate their property tax before paying. The payment process is the last thing after you learn what is needed how to calculate and so forth.

Details to know

The financial year starts at April and ends March next year whereby you have to pay the tax on 30th April. BBMP give big discount of 5% for those who pay for the given date. In case of delay or not paying an interest of 2% will accumulate and is taken as 24% for the whole year. The government also allows individuals to pay in two installments which don’t attract a fine nor discount.

BBMP Tax Payment Online 2024-25

Step by Step Procedure to pay bbmp property tax 2024-25 online payment

- First take the built up place plus the value per unit area and also the depreciation that can apply.

- Now multiply the unit area value, and the built up area after this multiply it by 10 representing 10 months.

- Minus the depreciation from the second step and here you will get the yearly value of the property.

- The annual value calculate the 20% of it to receive the property tax.

- Take the property you got calculate the 24% and get the cess applicable.

- Take the cess and the property tax added them together to arrive at the actual property tax.

- Since if you pay tax before the 30 the date you receive 5% discount.

- Take away 5% from the sum you got in step 6 and arrive at the amount to pay.

Process on Paying BBMP Property Tax online

- Go to the official website page and click on the link: http://bbmptax.karnataka.gov.in

- On the menu bar check for field to key in the SAS or the PID. This number is always attached at the last receipt received. Now go to the “fetch option” if the number is difficult to remember or not sure just press on renewal application number.

- Key in the details correctly for the property owner’s name to appear. After this press the confirm button.

- When submitted the details about your property will show look if they are ok.

- If some alterations a have occurred mark on the check box provided then proceed.

- Form V will be displayed for you to make the changes about your property.

- Proceed to the next step where the system will show you the new calculation about the property.

- A page will appear and all the information is already filled. The check box below must be unchecked thus making the page non-editable. The only space applicable is the mobile number which property owner can make changes to.

- After the processes above one needs to pay for the property tax using an e-challan or the debit card/net banking or credit card.

- A receipt is produced but takes 24 hours to show on the website. Download the receipt from the following link: http://bbmptax.karnataka.gov.in/forms/propertype=3

How to Pay Bruhat Bengaluru Mahanagara Palike Property Tax Offline?

The process is simple the property holder will need to fill form like form I to form V. which is according to where they fall. After this drop the forms at the BBMP offices whereby you make the payments using the demand draft.

How Strict is the BBMP on Property Tax?

Though the state seems to be making enough some individuals don’t bother paying or filling their returns. The government is very strict on property owners who have arrears of the past years. BBMP or government seizes moveable property like the furniture’s and business property you own.

However before the move is take strict warning are sent by the Bangalore government. The individual get notices and get a certain details. If they don’t respond their properties are collected from their home and business premise. Visit the BBMP offices and check how much money is required.

How to Print Bangalore Property Tax Receipt Online?

- Go to the official website: http://bbmptax.karnataka.gov.in/Forms/PrintForms.aspx?rptype=3

- The page will open on the menu bar select Downloads and select print application in drop down menu.

- On the sub menu choose the assessment year.

- Now enter the application number.

- Now recheck the information and submit.

- Print the application from the site for future reference.

Points to Remember.

- The parking and all the verandas are never included on the property tax or calculated.

- Residential which is not occupied can be said to self-occupy by the owner in order to calculate the property tax.

- Vacant land is also considered as property and has to be paid for.

- Early payments attracts discounts while the late payments will cause an additional interest rate.

- The BBMP doesn’t accept cash unless it is RS 1000. The rest one has to use a challan, debit/credit or net banking.

- Fill in the right forms according to the property you hold.

What is contained on the BBMP property tax receipt?

- Application number.

- The location where the payments were done.

- The year of assessment.

- The amount payable.

- For the demand drafts the receipt is given direct by the officers in charge.

Last date for bbmp property tax 2020

Last date for Bangalore Property tax payment for 2020 – 2021 year will be April 30th 2020 for availing rebate of 5%. For more visit bbmptax.karnataka.gov.in. May be due to covid-19 bharat lockdown this rebate last date will be extended to May 31st 2020. Please refer bbmp official webportal.