The GHMC Property Tax Payment Online 2023-2024 & Search by Door Number & House Number at https://www.ghmc.gov.in/Propertytax.aspx

GHMC Property Tax Payment

Greater Hyderabad Municipal Corporation Property Tax 2023-24: The Indian public amenities require finances for maintenance. Drainages, roads, public parks, and all public property are significant property that the government funds. However, the amount is raised from the tax imposed by the income tax department. This differs according to the states each having particular amounts.

Focusing on property tax, which is a great source of revenue for all states. The tax is derived from property owners. They pay through their municipalities, thus catering for all public needs. The funds are also used to pay state government employees maintaining the amenities.

The states have their way of payment some using online methods to collect taxes. The Greater Hyderabad municipality tax department, Telangana state is the main focus in the article payment and benefits of GHMC property tax.

The GHMC (Great Hyderabad Municipal Corporation) Property Tax 2023

The Hyderabad city citizens should pay property tax and other taxes each year. The practice is overseen by the Great Hyderabad Municipal Corporation. The funds are pooled together to facilitate all public amenities and services in the Telangana state. The body calculates the property tax using rental value and also taxation for all residential property.

Through technology, the tax department has an official website page. Here citizens can check their tax amount, one needs correct details such as names and property data to get the approximate amount. Note the value of the property varies according to the location of the property.

The GHMC Formula for Property Calculation

The tax department has different formulas when it comes to property tax. Residential value differs from the commercial value as follows:

Residential Property Tax Computation Formula

The annual property tax equals the Gross annual rental value (GARV)*(17 percent-30 percent). Slab rate this is determined by MRV as set by the GHMC -10 percent depreciation+8 library cess.

GARV equals the plinth area*monthly rental value in RS/Sq. ft.*12

| Monthly Rental value in Rupees | General tax | Other tax | Total |

| Up to 50 | Nil | ||

| 51-100 | 2 percent | 15 percent | 17 percent |

| 101-200 | 4 percent | 19 percent | |

| 201-300 | 7 percent | 22 percent | |

| 300 and above | 15 percent | 30 percent |

Note the plinth area is the whole build-up area. This is the balconies, garage and every related building on the property. The tax department uses other similar properties in the area to determine the value. For let-out property, the value/tax will be determined by the rental agreement.

The GHMC Commercial Property Tax Formula Computation

The annual property tax equals the 3.5*plinth area in Sq. ft. *Monthly rental value in RS/Sq. ft. The monthly rental value is a fixed value by the GHMC. The property and locality determine the value of the property and the amount to tax.

What are the Due dates & Penalty and other Rewards?

The GHMC has already set dates for tax payments. The dates are half-yearly where citizens have ample time to pay tax. The property tax payment is by July 31st and 1st October. Delays attract a penalty of 20percent interest every month for the given amount. Citizens also get rewards for early payment and if they clear previous debts. The rewards are give through lucky draws. This encourages citizens to pay their arrears and also pay in time.

GHMC New Property Assessment

The new property has to be assessed by the GHMC. The property owner submits an application form, sale deed, and occupancy certificate. The deputy commissioner assesses the property. The tax inspector also visits the property site for verification. They check the title deed and litigation if there is any. The verification will offer the correct property value. After all the details the owner will receive a property tax identification number. The number is unique to all taxpayers they also provide a house number.

Self-Assessment Online Process

The online scheme is an official way launched by the GHMC. New property owners can assess their property and send details online to the Greater Hyderabad Municipal Corporation Property Tax (GHMC) offices.

- The property owner needs to send the application form and personal details online.

- Indicating the property details such as deed, building and the permission number.

- Send the occupancy certificate number, where the property is located the type of building and the usage.

- The property tax will be calculate according to the details offered.

- Now, forward the information to the deputy commissioner.

- The tax officer will inspect and give special notice to the owner. A unique PTIN number will be offer for payments.

GHMC Property Tax Online Payment 2023-24

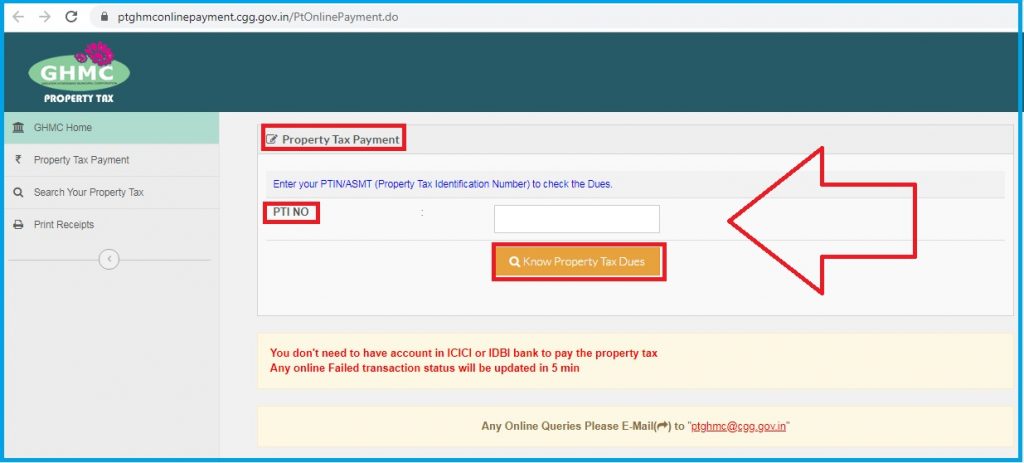

GHMC Online Payment 2023-24 step by step process: The PTIN identification number is used during the payment process. It’s unique to all taxpayers having 14 digits. Old property owners have the 10 digit PTIN number. Here property owner can check any details regarding the payment directly.

- Navigate to the official GHMC Online website

- https://onlinepayments.ghmc.gov.in/

- On the homepage key in the PTIN number.

- Proceed to click on the know property tax dues.

- Go to the options: arrears, property tax, interest on arrears, adjustments, etc.

- Fill you mobile number along with Email ID

- Now click on the make payment tab either by net banking, credit card/debit card.

- A new page on payments will show, key in your card details to make payments and complete the process.

Citizens can also deposit the payments directly at the tax offices. They can visit the Mee seva counters, bill collectors or the state bank of the Hyderabad b

ranch. If a cheque is made it should be directed to the commissioner of GHMC.

GHMC Property Tax Discount 2022 (Rebate)

- 5% Discount (Rebate) on Advance tax payment early bird rebate (ebr) for only Residential properties with Annual property tax below Rs 30,000/- up to 31st May 2022. More than Rs.30,000/- Annual Property tax Ghmc was not providing property tax rebate for 2022-23 (advance tax payment).

- For info please download this Memo PDF file: https://www.kmcgov.in/KMCPortal/downloads/PD_Schedule_2021-22.pdf

Exemption/Concession from payment of GHMC Property Tax

Exemption from property tax payment:

- The rate slab which is above the property and has a monthly market rental of RS.50/- is exempted.

- The property that is used as a charitable institution, a religious place or its owned by an ex-serviceman or present servicemen.

- They are automatically exempted from property tax.

- A 50 percent discount is given to properties with vacant premises if an official report is given by the tax inspector.

GHMC Property Tax Search Door & House Number

- First open this website https://ptghmconlinepayment.cgg.gov.in/SearchYourProperty.do

- Next select circle

- Fill PTIN NO

- Enter property person name of owner

- Fill door number

- Click on “Search property tax” option

Property owners can visit the official website page for more information on their tax value or payment. The site has official call numbers in case of an issue. They can also visit the tax department offices for enquires.