How to Register on eWay Bill Portal: The India’s Eway Bill Portal Registration 2023 and Eway bill generation services at Ewaybill.nic.in – Ewaybillgst.gov.in login

India’s digital Transformation impacts different sectors, including the GST or tax department. The government has implemented an advanced system to manage the movement of goods in the country. Eway bill is a digital replacement of the manual waybill system. Today transporters can access the Eway bill through a web portal http://www.ewaybillgst.gov.in/. The site is designed to generate, manage and cancel Eway bills. Transporters and taxpayers use electronic documents for transportation purposes. The user can move goods to various parts of India without legal complications. However, the Eway bill document applies if the good’s value exceeds INR 50,000.

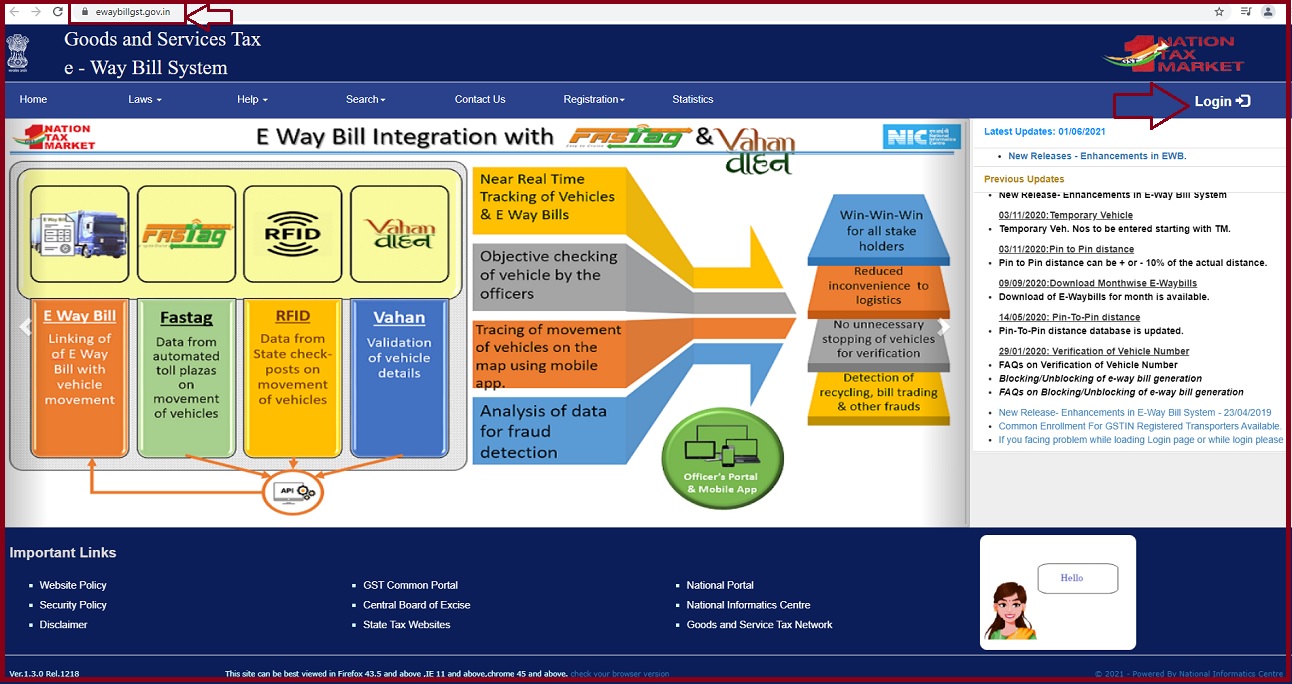

E-way Bills Portal

The EWB portal contains several significant features. An applicant should check each feature for easy access. How to register for e-way bill through e-way bill portal

Ewaybillgst.gov.in

Homepage

The homepage contains the following tabs:

- Laws

- Help

- Search

- Contact us

- Registration

- Login.

Every tab provides the user with different services. There are also services on the EWB website, which users can use when registering or generating Eway bills.

E-Way Bill:

- Generate new bill

- Generate bulk e-way bills

- Update part B

- The update vehicle bulk

- Update EWB transporter.

- Consolidated EWB

- Rejected

- Reports

- My masters

- User management

- Registration

- Update

- Grievance

Ewaybill.nic.in

How to Register on eWay Bill Portal ?

Requires Document for Eway Bill Registration process

- Operational/registered mobile number.

- The GSTIN for registered taxpayers

Types of E-way Bills Registration

- Registered suppliers

- Registered and unregistered transporters

- Unregistered suppliers.

The Registration process for registered suppliers

- Go to the E-way bill website portal via the link https://ewaybill.nic.in/

- On the homepage, select the option Eway bill registration.

- Next, enter your GSTIN login credentials and captcha code.

- Select the tab “go” to continue.

- Now request for OTP to verify the details.

- The system will provide and page with auto-filled details.

- Select the option “send OTP” button.

- Proceed and enter the OTP on your registered mobile number and click verify button.

- Now create a password and user ID and confirm the details.

- The system will provide an error message if the details are incorrect.

- Now you can log in with the login detail for Eway bill services.

Eway Bill Registration

Eway Bill Registration Steps for GST Registered/unregistered transporters

Requirements for unregistered transporters

- Unregistered transporters require an Eway bill if the goods’ consignment value for a single supplier exceeds Rs.50,000/-.

- If the goods in the vehicle exceed Rs.50,000/-.

- The unregistered transporter requires a transporter ID. The ID is indicated on all GST Eway bills.

Ewaybill.nic.in Registration Process

- Go to the Eway bill portal https://ewaybill.nic.in

- Select the option “enrollment for transporters.”

- Next, enter the required details as follows:

- Choose your state

- Enter your name.

- Trade name

- PAN number

- Type of enrollment.

- The system will verify the PAN card details and check for errors.

- If correct, proceed and select the type of warehouse, godown, cold storage, and transport services.

- Enter the constitution of the business and choose the business form from the drop-down list.

- Foreign company

- Partnership

- Private limited

- Public limited company.

- Others (BOI, AOP, HUF, etc.)

- The principal place for your business

- Enter your address and contact details (email ID, mobile, or landline number).

- The nature of premises

- Applicant’s Aadhaar details.

- Now tick the checkbox on the page to allow the portal to access your Aadhaar card details.

- Next, enter the following details:

- Aadhaar number, name, and mobile number.

- Select verify the detail and click the “Send OTP” tab.

- The system will send an OTP to the registered mobile number.

- Enter the OTP for authentication and wait for the confirmation message.

- Next, upload the required documents by clicking the “upload button.

- The documents are derived from your system. The portal will send an error message if the upload process fails.

- Now create the login details, enter a new username and password.

- The system will show whether the username is already taken.

- Select the verification button and select the “save” button.

- The applicant will receive a transporter ID. The number will help clients access GST eway bills. They can also add the vehicle number on the goods.

FAQs

Can the eway bill validity be extended?

Yes, the validity period can be extended in exceptional circumstances. Suppose the goods don’t reach the destination on time dues to some genuine reasons or natural causes. The transporter should provide information about the delays to get the extension.

What transactions require an e-way bill?

The Eway bill is provided if the goods transported exceed Rs. 50,000. The good can be from anywhere in the country.

Can I edit the Eway bill?

Part B of the bill allows users to edit the details. However, the other parts cannot be edited or updated. To change or correct the user must cancel the bill and apply a new one.